Wind power outfits have now cottoned on to the fact (slow learners that they are) that Australia’s big power retailers have turned their backs on the wind to face the Sun, instead.

The former second-hand car salesmen that front the wind industry are still coming to grips with the recalcitrance of commercial retailers (we don’t count the ACT Government) who continue to refuse entering Power Purchase Agreements with wind power outfits (holding that stance since November 2012).

The big operators have absolutely no interest in wind power; and every interest in killing off the Large-Scale RET that created, and for the time being sustains, the wind industry.

As pointed out previously, the retailers’ switch to large-scale solar is a canny, but fleeting move – designed to avoid the shortfall penalty for the few years it takes for the LRET to collapse; as the political and economic toxicity of the policy escalates over the next year or two.

It is, after all, a pointless $3 billion a year power tax that runs until 2031 – for no other reason than to subsidise the production of insanely expensive and wholly unreliable wind power; at a time when Australia’s grid is swamped with oodles of the reliable, secure and affordable stuff.

Without PPAs with retailers, wind power outfits haven’t a hope in hell of obtaining bank finance to build any new wind farm capacity, as this ‘sackcloth and ashes’ piece from the SMH confirms.

Yass Valley Wind Farm recommended for approval, but retailer’s strike persists

Sydney Morning Herald

Lucy Cormack

4 February 2016

Financiers are yet to gain confidence that the legislative underpinning for renewable energy projects is going to be stable.

The state government has recommended approval for what could be one of Australia’s biggest wind farms, but continued uncertainty in the renewables sector may see the project added to the 6000 megawatt-strong “pile of wind farms” currently approved, but stalled, industry figures say.

The recommendation for approval of the Epuron Yass Valley Wind Farm by the NSW Department of Planning and Environment clears the way for the Planning and Assessment Commission to make its final decision on the wind farm.

While industry figures say the news is positive, it does not mean the wind farm will be built.

“This approval just adds to the 6000-megawatt pile of wind farms currently stalled:” Ric Brazzale, managing director …

“This approval just adds to the 6000-megawatt pile of wind farms currently stalled:” Ric Brazzale, managing director Green Energy Trading said of the Yass Valley Wind Farm.

“We’ve lost count of these announcements,” said Ric Brazzale, managing director of Green Energy Trading.

“It’s an important part of the process, but this approval just adds to the 6000-megawatt pile of wind farms currently stalled.”

The battle for new projects is obtaining finance and power purchase agreements: contracts with energy companies to sell electricity and large-scale generation certificates (LGCs).

Large-scale generation certificates are used by Renewable Energy Target-liable entities to meet compliance obligations based on the volume of electricity they purchase each year.

Mr Brazzale said the difficulty in sealing power purchase agreements is tied to the long-embattled context of renewable energy in Australia.

“They can’t raise finance because banks and financiers don’t want to go anywhere near these contracts unless they are contracted with energy retailers,” he said.

“So, why don’t financiers do it? The reason is, they are yet to gain confidence that the legislative underpinning is going to be stable,” he said. “We’ve heard from Greg Hunt and that helps, but if you want retailers and financiers to change, you need the Prime Minister to come out and say unequivocally, ‘We are not going to reduce the target.’”

Solar Council chief executive John Grimes agreed that any “drought” in renewables investment will only be reversed with increased positive sentiment from the government.

“Large scale projects are all built on policy, stability and confidence, but the entire renewable energy market has been massively disrupted by the federal government’s review and slashing of the Renewable Energy Target.”

Mr Grimes’ concern is that, despite having a new Prime Minister, “nothing has changed”.

“No moves have been made by the federal government to ensure that certainty and policy stability is returned to the sector,” he said. “It’s a double-edged sword. If power companies don’t build projects they will be slugged with a charge equivalent, which has a real post-tax value of $93 per large-scale generation certificate.”

Mr Grimes said liable entities are using that fact to go back to the government and say they cannot build the projects to meet the target in the time permitted.

“Their argument will be, if the federal government doesn’t slash the Renewable Energy Target again, then that price will be passed through to consumers and everyone will be paying for capacity that was never built,” he said.

At its proposed capacity of 124 turbines, the Yass Valley Wind Farm would have the capacity to power more than 130,000 homes each year, however the government’s recommendation suggests a significant reduction in the project’s scale, down to 79 turbines.

Epuron executive director Martin Poole said despite the recommended reduction “attitudes everywhere have improved” towards wind energy, since Prime Minister Malcolm Turnbull took the leadership.

“It is important that NSW demonstrates its commitment to maximising the local jobs and expertise that flow from the transition to a cleaner electricity sector.”

Mr Brazzale estimates that processes contracting for large-scale generation certificates in the ACT, Western Australia, South Australia and Victoria suggest “there are probably more than 1000 megawatts of projects that could be committed over the next year or so.”

Despite being enough to power around 430,000 homes annually, Mr Brazzale said that figure is nowhere near enough to meet the large-scale renewable energy target by 2018.

“We need four times that level to ensure we meet the 2018 target, which obviously we’re not going to achieve. That’s why the LGC price is high, because it’s reflecting that the market is not going to meet the target.”

Sydney Morning Herald

The usual fawning starry-eyed ‘analysis’ from Fairfax there – with bunkum about a pie-in-the-sky wind farm one day “powering more than 130,000 homes”. Unless those households are prepared to sit freezing or boiling in the dark around 70% of the time, they will, in fact, be ‘powered’ by coal, gas and hydro (in that order).

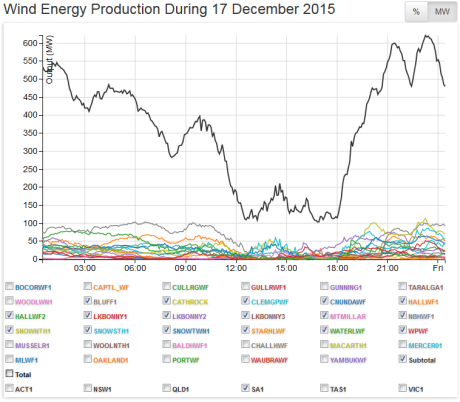

That journalists are still pushing that kind of wind industry propaganda in 2016 is not just dumb, it’s lazy. A quick glance at Aneroid Energy debunks that myth. Here’s SA’s 17 wind farms (notional capacity of 1,477MW) ‘powering’ not so much as a kettle on 3 May 2015:

The other line that escapes any sensible criticism from Fairfax is what John Grimes says about the looming and massive cost of the LRET

“It’s a double-edged sword. If power companies don’t build projects they will be slugged with a charge equivalent, which has a real post-tax value of $93 per large-scale generation certificate.” …

“Their argument will be, if the federal government doesn’t slash the Renewable Energy Target again, then that price will be passed through to consumers and everyone will be paying for capacity that was never built,”

The cost of the LRET to power consumers will actually be lower if further wind power capacity is NOT built, than if it is. Retailers will get hit with the shortfall penalty (what Grimes calls ‘a charge equivalent’) and the cost of the REC – from here, the combined cost of which will exceed $3 billion a year, all recovered as a Federal Tax on all power consumers:

What Kills the Australian Wind Industry: A $45 Billion Federal Power Tax

What Grimes leaves out, of course, is that the wind power capacity that Epuron, Infigen & Co are so desperate to build (in order to keep their Ponzi scheme from collapsing, as it has with Pacific Hydro) – will cost at least a further $80-100 billion, in terms of extra turbines and the duplicated network costs needed to hook them up to the grid: all requiring fat returns to investors; costs and returns that can only be recouped through escalating power bills:

Ian Macfarlane, Greg Hunt & Australia’s Wind Power Debacle: is it Dumb and Dumber 2, or Liar Liar?

In the post above we looked at the additional costs of building the wind power capacity needed to avoid the shortfall penalty – including the $30 billion or so needed to build a duplicated transmission grid.

That is, a network largely, if not exclusively, devoted to sending wind power output from remote, rural locations to urban population centres (where the demand is) that will only ever carry meaningful output 30-35% of the time, at best. The balance of the time, networks devoted to carrying wind power will carry nothing – for lengthy periods there will be no return on the capital cost – the lines will simply lay idle until the wind picks up.

The fact that there is no grid capacity available to take wind power from remote locations was pointed to by GE boss, Peter Cowling in this article, as one of the key reasons that there will be no new wind farms built in Australia (see our post here).

But let’s return to wailing about the requirement for policy ‘certainty’. What that wailing is really about, is a plea for the Federal government (read ‘taxpayer and power consumer’) to underwrite a politically toxic policy, that has already been slashed from an ultimate annual target of 41,000GWh to 33,000GWh, for precisely that reason.

In 2015, faced with the fact that the target could never be met, both Labor and the Coalition were forced to cut the target before the shortfall penalty inevitably took effect. But that was simply to stall the LRET’s ultimate collapse: the same factors Epuron moan about above are still in play. There will be no increase in wind power capacity; the shortfall penalty will apply; and the Federal government will be forced to cut the target, once again.

It’s the fact it was cut once that has bankers and retailers refusing to lend or sign PPAs. And, as with any ‘business’ that relies for its very existence on a piece of policy, what the government once did, can be just as easily undone – in full.

What kills the LRET – and the wind industry with it – is the same set of forces that led to the demise of the Australian wool industry. The lessons and parallels drawn from the implosion of its Federally mandated subsidy scheme during the 1990s – all but killing the industry and costing growers and taxpayers tens of billions of dollars – are worth repeating.

The wool industry’s “cause of death” was the Federally backed Reserve Price Support scheme (RPS), which set a guaranteed minimum price for all Australian wool.

A little background on the RPS

For over 150 years, Australia happily rode on the sheep’s back: until the 1970s the wool industry was, for the Australian economy, the “goose that laid the golden egg”; textile manufacturers from all over the world clamoured for the fibre; which was, for most of that time, the largest single commodity export by value; Australia produces over 80% of the world’s apparel wool. However, as fashions changed (the three-piece wool suit became, well, so “yesterday”) and new synthetics began to eat into its market share, the dominance of Australian apparel wool was no longer a certainty.

Against the backdrop of increasing competition, for the wool industry there was always the perennial issue, not only of fluctuating demand, but also of wildly fluctuating swings in production. Dorothea McKellar’s land of “droughts and flooding rains” meant that a few years of meagre production (and favourable, and even phenomenal, wool prices) would be soon eclipsed by sheds and wool stores overflowing with fibre ready for market (sending prices and woolgrower profits plummeting).

The response to these (often climate driven) marketing “swings and roundabouts”, was the establishment of the Australian Wool Corporation (AWC) and the RPS in 1973.

The RPS would set a minimum price for all types of wool, guaranteeing woolgrowers a minimum return; such that if supply exceeded demand, the AWC would purchase any wool being offered, if it failed to reach the minimum price set (referred to as the “floor price”).

Wool being offered at auction that failed to meet the floor price was purchased by the AWC and “stockpiled” (ie stored), until such time as either supply fell or demand conditions improved; at which point the AWC would offer stockpiled wool to the trade. The aim being the smooth and more orderly marketing of wool over the supply and demand cycle; with higher average returns to growers; and less risk for buyers and sellers along the way.

The scheme worked swimmingly (as designed and intended) until the late 1980s.

The reserve price set under the RPS was fixed in Australian dollar terms. However, with the float of the Australian dollar in 1983 (resulting in a massive 40% depreciation of the dollar between February 1985 and August 1986), maintaining the reserve price without reference to the terms of trade and fluctuations in trading currencies (particularly the US dollar) set the scheme up for a spectacular failure; simply because what goes down can just as easily go up.

During the 1980s, there was a solid increase in demand for wool, driven by demand from the USSR, a then fast growing Japan, buoyant Europeans, and a newly emergent China, as a textile manufacturer and consumer. However, that surge in demand occurred in the context of an Australian dollar trading in a range around US$0.55-75.

During the 1980s, under pressure from wool grower lobby groups, the floor price was continually increased: from 1986 to July 1988 the floor price jumped 71% to 870 cents per kilogram.

That did not, in itself, create any problems: a general surge in demand, relatively low production and a plummeting Australian dollar generated auction room sale prices well above the rising floor price, which reached their zenith in April 1988: the market indicator peaked at 1269 cents per kg, and the market continued its bull run for most of that year, well above the 870 floor price set in July.

However, as international economic conditions worsened, Australian interest rates soared (the consequence of Paul Keating’s “recession that we had to have”) and the value of the Australian dollar with it (hitting US$0.80 by early 1990), the market indicator headed south and, over the next few years, the AWC was forced to purchase over 80% of the Australian wool clip at the 870 cent per kg floor price. Adding to the AWC’s difficulties was a massive surge in production; driven by growers responding to the high and “guaranteed” floor price; and a run of exceptional growing seasons (1989 being a standout across Australia). Production went from 727 million kg in 1983/84 to over 1 billion kg in 1990/91.

Despite worsening market conditions, the AWC, under pressure from wool grower lobby groups, was forced to maintain the 870 cent per kilogram floor price.

However, from around August 1989, international wool buyers simply sat on their hands in auction sale rooms (in May 1990 the AWC bought 87.5% of the offering); and waited for the RPS to implode.

Knowing that the system was unsustainable, the last thing that buyers wanted was to be caught with wool purchased at prices above the floor price which, when the floor price was cut or collapsed, would immediately be worth less than what they had paid for it. Moreover, traders were dumping stock as fast as they could to avoid the risk of a collapse in the RPS and, therefore, a collapse in the price of any wool they happened to hold.

The RPS was ultimately backed by the Federal government. With the buying trade sitting on their hands, those responsible for maintaining the floor price ended up in a staring competition, the only question was, who would blink first: the AWC (or, rather, the government underwriting the RPS); or the buyers?

With the AWC purchasing millions of bales of wool at the floor price the cost of supporting the RPS was running into the billions of dollars: primarily the support came from a grower levy on sales, but, at the point which that soon became insufficient to support the RPS (despite upping the levy from 8% to 25%), support came from $billions in mounting government debt; the buyers had no reason to blink.

Instead, in May 1990, the government announced its decision to retreat to a new floor price of 700 cents per kilogram, and directed the AWC to fight on in support of the reduced floor price. The Minister for Primary Industry, John Kerin boldly asserting that the 700 cent floor price was “immutable, the floor price will not be reduced”.

But, having blinked once, the buyers largely continued to sit on their hands and simply waited for the government to blink again. The stockpile continued to balloon; and with it government debt: by February 1991 the stockpile reached 4.77 million bales (equivalent to a full year’s production); the accrued government debt stood at $2.8 billion; and the cost of storing the stockpile was over $1 million a day.

Faced with the inevitable, the government blinked, again: John Kerin was forced to eat his words about the floor price being “immutable”; on 11 February 1991, announcing the suspension of the floor price. The RPS had totally collapsed; the buyers had won.

The wool industry’s saga is beautifully, if tragically, told by Charles Massy in “Breaking the Sheep’s Back” (2011, UQP), which should be required reading for any of our political betters pretending to know more than the market (eg, the power market).

Which brings us to the lessons and parallels.

The LRET effectively sets the price for RECs: the minimum price is meant to be set by the shortfall charge of $65 per MWh (rising to $93 when account is given to the tax benefit), as the penalty begins to apply on the shortfall (as detailed above). That equation is based on an ultimate 33,000 GWh target.

In the event that the cost of the shortfall charge was reduced, there would be a commensurate fall in the REC price. Likewise, if the LRET target was further reduced: the total number of MWhs which would then attract the shortfall charge if RECs were not purchased would fall too; also resulting in a fall in the REC price.

In addition, any reduction in the LRET would simply result in a reduction in the demand for RECs overall: fewer RECs would need to be purchased and surrendered during the life of the LRET; again, resulting in a fall in the REC price. Of course, were the LRET to be scrapped in its entirety, RECs would become utterly worthless.

The retailers, are alive to all of this, hence their reluctance to enter PPAs for the purpose of purchasing RECs; agreements which run for a minimum of 15 years.

In December 2014, Ian “Macca” Macfarlane and his youthful ward, Greg Hunt started running around pushing for a target of 27,000 GWh; and their boss, Tony Abbott made clear that he wanted to kill it outright. There followed overtures from the Labor opposition pitching for a target around 35,000 GWh.

Whether they knew it or not – with their public debate on what an amended target should be – in the staring competition with retailers – these boys blinked.

Faced with the inevitable political furore that will erupt when power consumers (ie, voters) realise they are being whacked with the full cost (and some) of the shortfall charge (being nothing more than a “stealth tax” to be recovered by retailers via their power bills), the pressure will mount on both sides of politics to slash the LRET – once again.

That both Labor and the Coalition have already blinked (in obvious recognition of the brewing political storm in power punter land over the inevitable imposition of the shortfall charge) is not lost on the likes of Grant King from Origin, and all of Australia’s other electricity retailers.

And for retail power buyers the choice of sticking with permanent recalcitrance has been made even easier: with the previous PM Tony Abbot making it plain that he would have cut the LRET even harder, were it not for a hostile Senate; and Labor’s Bill Shorten pushing for an entirely ludicrous 50% LRET – that would require a further 10,000 of these things to be speared all over Australia’s rural heartland. Where there was once ‘bipartisan’ support for these things, the major parties are diametrically opposed.

****

With the politics of the LRET already on the nose, like wool buyers sitting on their hands in sale rooms during 1990, waiting for the floor price to collapse, electricity retailers need only sit back and wait for the whole LRET scheme to implode.

Like wool buyers refusing to buy above the floor price and carry stock with the risk of the RPS collapsing, why would electricity retailers sign up for 15 year long PPAs with wind power outfits in order to purchase a stream of RECs over that period, knowing the value of those certificates depends entirely upon a scheme which is both economically and politically unsustainable?

However, the similarities between the wool market and the market for wind power end right about there.

There is, and always was, a natural market for Australian wool; the only issue during the late 80s and early 90s was the price that had to be paid by buyers to beat the floor price, set artificially under the RPS.

Wind power has no such market.

Available only in fits and spurts, and at crazy, random intervals, at a price which is 3-4 times that of conventional generation, retailers have no incentive to purchase it.

In the absence of the threat of the $65 per MWh fine (the stick), coupled with the promise of pocketing $93 as a subsidy in the form of a REC (the carrot), electricity retailers would not touch wind power with a barge pole: it simply has no commercial value.

Moreover, with an abundance of conventional generation capacity in Australia at present, retailers are very much in a “buyers’ market”.

Overcapacity, coupled with shrinking demand (thanks to policies like the LRET that are killing mineral processors, manufacturing and industry) means that retailers can expect to see wholesale prices decline over the next few years, at least. And, for the first time in almost 20 years, a sharply declining Australian economy is a fast looming reality: unemployed households have an even tougher time paying rocketing power bills.

With those fundamentals in mind, electricity retailers will simply opt to pay the shortfall charge and recover it from power consumers, knowing that that situation will not last for very long.

Sooner or later, the Federal government (whichever side is in power) will have to face an electorate furious at the fact that their power bills have gone through the roof, as a result of a policy that achieved absolutely nothing.

Current PM, Malcolm Turnbull might mouth platitudes about ‘renewables’ and ‘innovation’, but his chances of leading the Coalition to a second term in power are tied to fundamental ‘mum and dad’ policies like electricity costs.

Power prices matter; and in a battle between Australia’s Big 3 Retailers and the LRET, STT’s money is firmly on commercial self-interest.

STT hears that the big retailers plan to exhaust the pile of RECs that they’re sitting on at present, while building a few large-scale solar power facilities, in order to obtain the RECs needed to avoid the shortfall charge; and to wait for the politics to turn gangrenous. As soon as the LRET gets scrapped, the plan is to sell the panels back into the residential roof-top market.

The cost of the LRET – and all that comes with it – to retail customers is at the heart of what’s driving retailers’ efforts to crush the LRET; and the wind industry with it.

This might sound obvious, if not a little silly: electricity retailers are NOT in the business of NOT selling power.

Adding a $45 billion electricity tax to retail power bills can only make power even less affordable to tens of thousands of households and struggling businesses, indeed whole industries, meaning fewer and fewer customers for retailers like Origin, AGL and EnergyAustralia.

The strategy adopted by retailers of refusing to ‘play ball’ by signing up for PPAs will, ultimately, kill the LRET; it’s a strategy aimed at being able to sell more power, at affordable prices, to more households and businesses.

And it’s working a treat, so far.

The wind industry’s incessant daily whining about “uncertainty”, is simply a signal that the retailers have already won. Once upon a time, the wind industry and its parasites used to cling to the idea that the RET “has bi-partisan support“, as a self-comforting mantra: but not anymore. And it’s the retailers’ refusal to sign PPAs that’s thrown the spanner in the wind industry’s works.

While the likes of Epuron and Infigen will continue to work themselves into a lather about their inevitable fate, in the meantime, retailers, like Origin, AGL and EnergyAustralia, can simply sit back, watch the political fireworks, and wait for the inevitable and complete collapse of the LRET; and, with it, the Australian wind industry.

In this ‘drought’ only the retailers have the capacity to survive.

of this Memorandum of Understanding and what followed now pay the highest power prices in the Nation – if not the world, on a purchasing power parity basis – and suffer daily power interruptions and even Statewide wind power blackouts) can only wonder what happened to the promised Vesta’s “blade manufacturing facility”, and the hundreds of ‘groovy-green’ jobs supposed to have been attached to it?

of this Memorandum of Understanding and what followed now pay the highest power prices in the Nation – if not the world, on a purchasing power parity basis – and suffer daily power interruptions and even Statewide wind power blackouts) can only wonder what happened to the promised Vesta’s “blade manufacturing facility”, and the hundreds of ‘groovy-green’ jobs supposed to have been attached to it?